A Reality Check for Your Wealth Strategy

Nov 12, 2025

When The Experts Act Like They Know

We don’t like living with uncertainty, especially where money is concerned. A misjudgement can carry a long shadow, leaving years of regret.

Meanwhile, many in the financial industry act as if they have certainty. Weekly market outlooks, property-market forecasts, commentary full of “where we’re headed”. It gives the impression that someone knows what’s coming.

But the truth? Very few do.

We’re taught elegant investment models that assume neat behaviour, full transparency and predictable outcomes. Reality doesn’t oblige. Markets are messy, human behaviour is unpredictable, and chance has a seat at the table.

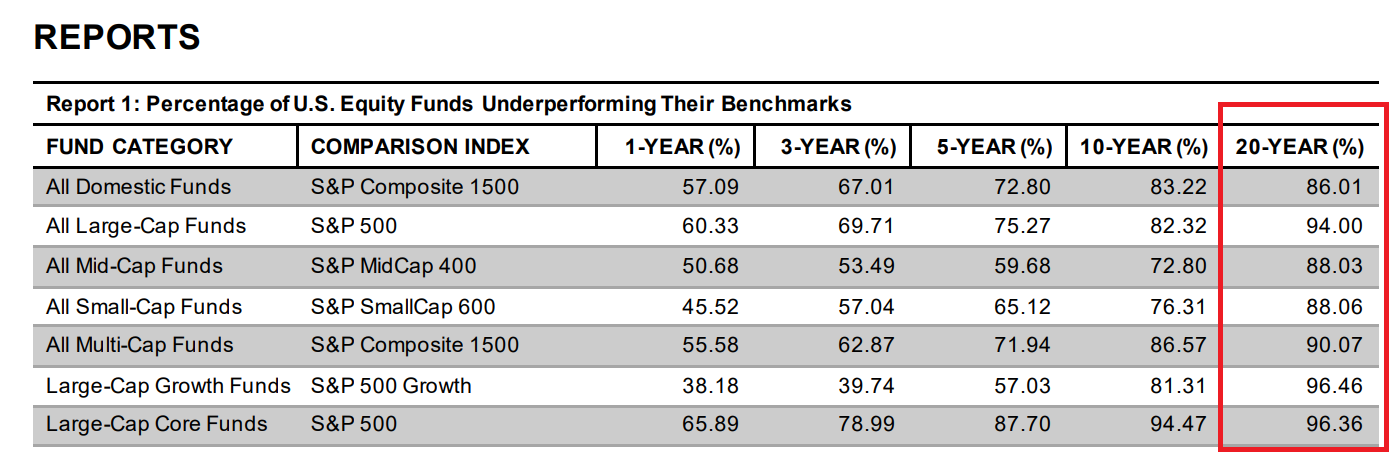

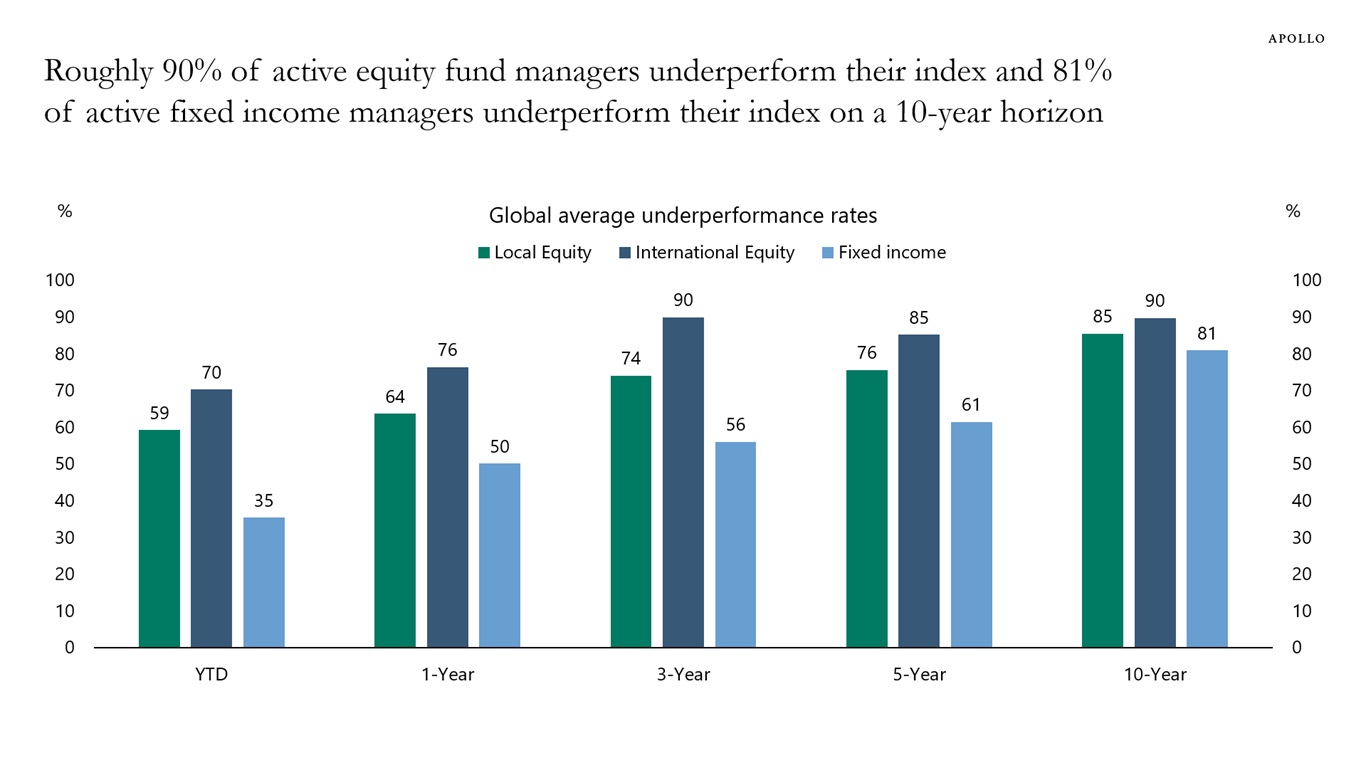

According to the latest global data, around 80 % to 90 % of active equity fund managers have failed to beat their benchmark over the past 10 years. (apolloacademy.com)

And in Australia, the trend is stark: over the decade to June 30 2025, about 94 % of global equity managers and 84 % of Australian general equity managers under-performed their benchmark. (Australian FinTech)

So let’s ask: why do we place so much faith in predictions and market-timing when the odds are clearly against consistent outperformance?

Why the Hedge Funds and Stock Pickers Sound So Certain (and Why You Should Listen with a Filter On)

-

Their remuneration often depends on positioning being “right” looks good, even if the outcome is uncertain.

-

Models exclude the messy bits: human error, behavioural bias, structural shifts, black swans.

-

Complexity sells: “special” strategies, insider language, charts and jargon. It imbues confidence.

But the data says: long-term, most active managers don’t justify their higher fees and higher risk.

A Contrarian Perspective for 2025-26

Here’s where we diverge from common commentary: Don’t assume you must dismiss active management entirely. The edge is simply far narrower than many believe.

In Australia, for example, while the broad large-cap market has been efficient, mid-small capitalisation stocks and certain bond-segments have shown that some active managers have out-performed recently (though even in those cases long-term consistency remains rare).

So the practical angle for you: If you choose active management, pick your battles. Don’t apply it across the board. Use it in segments where inefficiencies exist and fees are modest. For the bulk of your wealth in highly efficient markets, a simpler, disciplined approach often wins.

Three Principles That Matter More Than Predictions

-

Prioritise risk control over chasing return

Investing isn’t a sprint. The damage from a large loss compounds. The first job: preserve capital. -

Cost and friction erode outcome

Fees, taxes, turnover: they all drag. If a manager under-performs by even a small margin and you’re paying high fees, the disadvantage accumulates. The SPIVA data stress this clearly. -

Build frameworks, not forecasts

Focus on what you can control: asset allocation, diversification, discipline, rebalancing. Avoid attempting to ‘beat the market’ through guessing. The markets don’t hand out fairness. They reward structure and consistency.

How Total Money Management Does This Differently

We’re not in the business of offering certainty. We offer structure and clarity.

At TMM we teach:

-

How to hedge exposures (for example using ETFs and disciplined rebalancing)

-

How to apply trend filters and volatility frameworks instead of speculative bets

-

How to manage the behavioural and psychological side of wealth (since clients, not markets, are often the biggest risk)

Conclusion

Uncertainty isn’t the enemy, pretending you know the future is. The market doesn’t care about your confidence or your narrative.

Rather than chasing predictions and handing over your wealth based on someone’s conviction, start with structure. Focus on risk, cost, discipline and where you can genuinely add edge.

If you’d like to explore how to build a framework aligned with your goals, let’s talk.

Enjoying our Blogs?

Our Investing Essentials subscription might be worth looking into, get more specific detail below if you're interested in upskilling.

Stay connected to our blog

Join our mailing list to receive the latest news and updates from our team including blogs, live events, podcast releases and stocks to watch.

Your information will not be shared.

We hate SPAM. We will never sell your information, for any reason.