I'm Certain

Oct 09, 2025

Finance folks are always saying the market is unpredictable. But if you look at history, it clearly shoes patterns or trends depending on your timeframe.

The finance theory posits that market return are random, however over the longer term even if a system is random, there is still long term predictability. After all, we know that any single coin flip is unpredictable, but we also know over the long term with a fair coin we can expect to see roughly 50% heads and 50% tails. So if there is a really long run of, say, heads, then tails may be expected to have its own run, thus mean reversion.

The unpredictable bit is when do they turn? But that is not the right question.

The question is how do we protect our capital by reducing our risk of losses?

One way is to realise these patterns and adjust your asset allocation accordingly. This does require some patience, but it is a very effective way of reducing risk where there is periods of higher volatility.

Another way is to use shorter term indicators like moving averages. The big losses happen below the 200 SMA and so we can decide at each point where the market meets the 200 SMA line to change our allocation by rebalancing. This method has historically been able to protect capital especially when there are large falls and these are generally when the market has experienced a strong upward trend to the point that it becomes overvalued.

The question we should be asking ourselves is whether after a seriously good run, should we expect a reversion? And the answer is yes.

So I cant tell you whether the next coin flip is a heads or tails, but I can tell you after a very strong run for either, it is more likely to revert to the longer term average of 50/50.

That’s the way you should treat your portfolio.

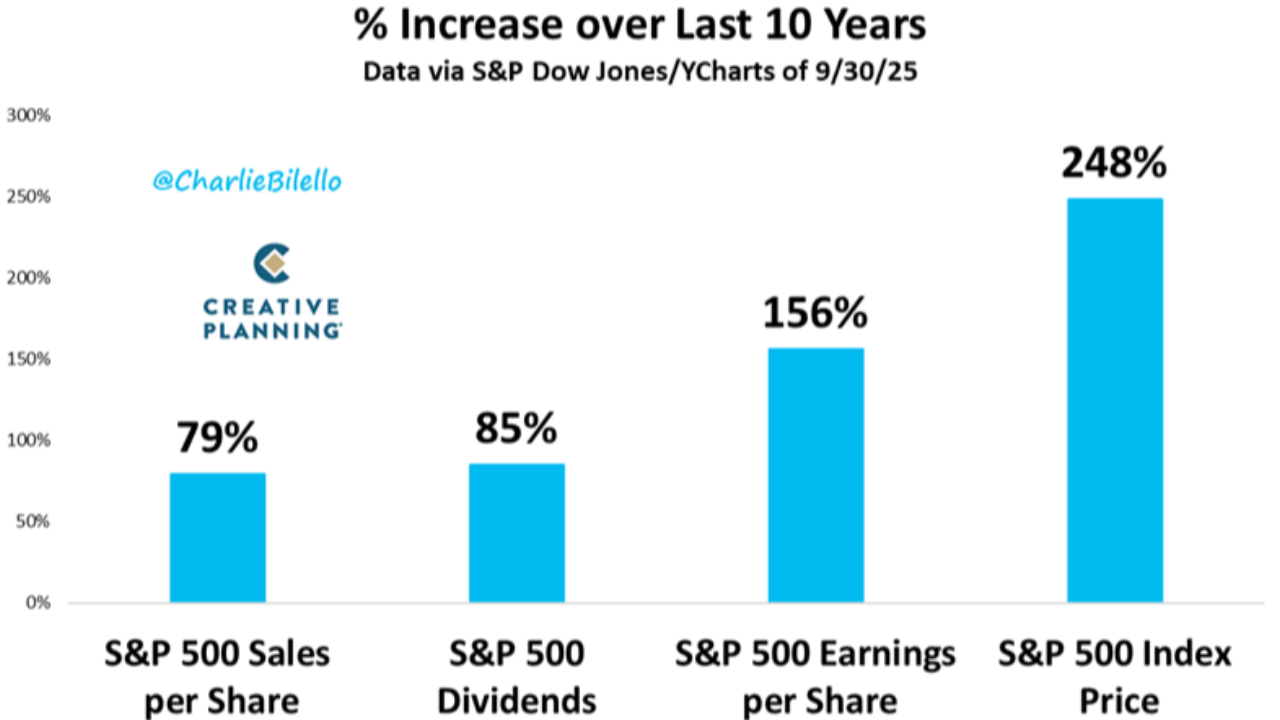

After a 16 year bull market where the CAPEW has moved from a below average 12 to its second highest reading of 40, it’s time to be fearful.

Invest accordingly.

Enjoying our Blogs?

Our Investing Essentials subscription might be worth looking into, get more specific detail below if you're interested in upskilling.

Stay connected to our blog

Join our mailing list to receive the latest news and updates from our team including blogs, live events, podcast releases and stocks to watch.

Your information will not be shared.

We hate SPAM. We will never sell your information, for any reason.