Starting to Invest?

Jan 22, 2026

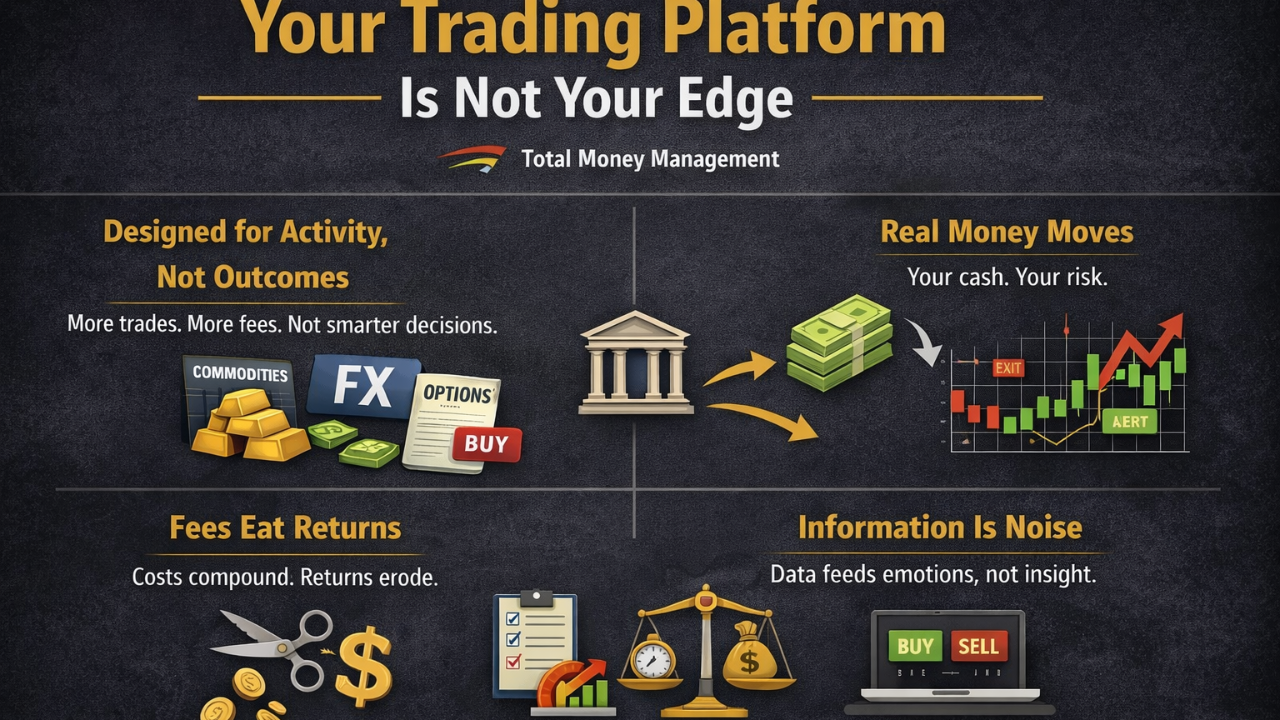

Your Trading Platform Is Not Your Edge

If you want to buy shares, you need a platform. In Australia that usually means an online broker like CommSec or one of the newer low-cost alternatives.

Most platforms are easy to open and largely interchangeable. Identity checks, linked bank account, access to Australian and sometimes international markets. Functionally, they all do the same thing.

And that is the first thing to understand clearly.

A platform does not make you a better investor.

Platforms Are Designed for Activity, Not Outcomes

Trading platforms are businesses. They earn money when you trade. Every buy and sell generates brokerage, regardless of whether the decision was sensible or reckless.

This creates a quiet but powerful incentive problem.

New investors are shown hundreds of products they do not understand. Commodities, currencies, leveraged ETFs, CFDs, options. All presented with the same visual weight as high-quality businesses or broad market ETFs.

The platform does not care what you buy. It cares that you buy something.

This is why so many investors young and old confuse access with skill. Being able to trade does not mean you should.

How the Money Flows Actually Matters

Every platform links to an account. That account is where capital is drawn from when you buy and where proceeds land when you sell. Dividends flow there too.

This sounds obvious, but it is important psychologically.

You are not playing with numbers on a screen. You are moving real capital between cash and risk assets. Platforms make this feel frictionless, which is precisely the danger.

Some platforms pay a small amount of interest on idle cash. That is not a return strategy. It is a holding pen between decisions.

Fees Are the Silent Tax on Impatience

Brokerage is either a flat fee or a percentage of trade size. On any single transaction it looks trivial.

Over time, it is not.

Frequent trading without a strategy compounds costs in the same way returns compound wealth. The difference is costs compound in the wrong direction. They quietly eat performance without ever showing up as a line item in your portfolio return.

Information Is Not Insight

Once you own shares, the platform gives you endless data. Live prices during Australian Securities Exchange market hours, charts, indicators, volume, news alerts, price movements down to the second.

None of this improves decision making on its own.

In fact, constant visibility often makes outcomes worse. Watching prices move trains investors to react rather than think. It turns investing into a stimulus-response loop.

Good investing is slow. Platforms are built to feel fast.

The Order Matters

Most people start with the platform and then look for something to buy.

That is backwards.

The correct order is framework first, risk second, assets third, platform last.

A platform is just plumbing. It executes decisions. It does not create them. Without a clear view of risk, valuation, and time horizon, the platform simply accelerates mistakes.

At Total Money Management, we do not teach people how to trade more efficiently. We teach them how to make fewer, better decisions with clearer intent.

The platform is the least important part of the process.

If it feels exciting, you are probably doing it wrong.

Enjoying our Blogs?

Our Investing Essentials subscription might be worth looking into, get more specific detail below if you're interested in upskilling.

Stay connected to our blog

Join our mailing list to receive the latest news and updates from our team including blogs, live events, podcast releases and stocks to watch.

Your information will not be shared.

We hate SPAM. We will never sell your information, for any reason.