The More Things Change........

Dec 04, 2025

In the old days many sports had rules that stayed the same for a long time. Continuity took precedence over change. Only occasionally would sports like tennis change to adapt to new technology or player’s behaviour.

For example, the wooden rackets gave way to metal and now graphite allowing players to hit harder. They changed the balls to make rallies longer.

They used to have three people at one end in three people at the other end to determine whether the ball was in or out but now a camera does the hard work.

But through all these changes the game of tennis remains the same. Yes, players are bigger, stronger and probably more agile, but the essence of the game remains.

It is the same in markets. The point I’m trying to make is we can often be seduced by the idea that this time is different or, the here and now is different. This is especially visible when stocks experience a long term bull market.

CAPE be damned!

However, the reality is besides all these changes the game remains the same. In many domains, like tennis, we think that we have undergone substantial change when in fact the structure and characteristics have remained the same.

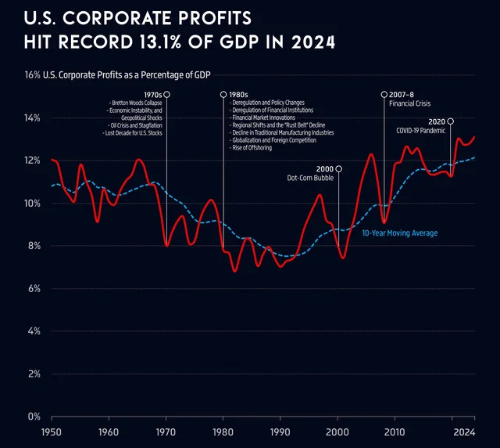

In investing through all the changes such as railways, airlines, the internet, and now artificial intelligence, the stock market is still a place where the profits are distributed between capital and labour and over time, one can not continue to dominate forever. Capital or business owners have experienced a massive run for the past 30 years. In 1999, Buffett said corporate profits at 6% could not be expected to continue and would revert to their long term average. It’s 2025, and they are even higher!

Warren Buffett, despite all the changes in the past 80 to 90 years invested successfully using the same formula in 2020 that he used in 1950. This has to inform what we call the modern investor that the period we live through with “unprecedented change“ is simply the cycles or the fundamental characteristics reasserting themselves. It is our own human nature to want stability, but believe the world around us is changing rapidly.

For all the talk of technological “progress“, we can see that while technology may change some aspects of our lives in terms of investing, ultimately all excess income (profit) is a matter of distribution between shareholders and staff. And here we see there are cycles where workers receive a great portion of the profit and at other times where company owners/shareholders receive more of the profits.

We think the times are changing where profits will take a backseat to wages and this will result in lower capital returns for perhaps one or two decades.

This will seem like a huge change, but if you study history, you will understand the changes will only be a repeat of other eras where one side dominates for an extended period but not forever.

We often think we are progressing somewhere when in fact we are just going round in circles. While they have undergone many changes and added creature comforts, cars are still a mode of transport used to get you from point A to B (but car companies are still terrible investments as they have been for a long time).

Enjoying our Blogs?

Our Investing Essentials subscription might be worth looking into, get more specific detail below if you're interested in upskilling.

Stay connected to our blog

Join our mailing list to receive the latest news and updates from our team including blogs, live events, podcast releases and stocks to watch.

Your information will not be shared.

We hate SPAM. We will never sell your information, for any reason.